June 19, 2019 Industry news

The results from our product data survey are in: it is clear that consistent, high-quality data is now of paramount importance to branded suppliers in the grocery industry

A couple of months ago, we asked you to take part in a short survey to help us better understand your pain points when it comes to managing and sharing product data in the grocery sector. The results we received were conclusive.

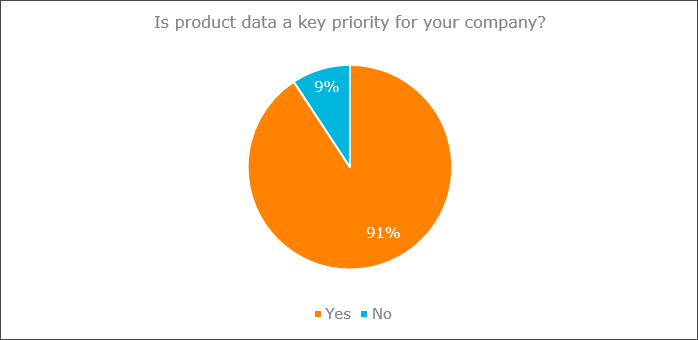

Product data is seen as a key priority for 91 per cent of respondents. The 9 per cent who don’t see it as a priority come from companies in the less than £10m annual turnover band.

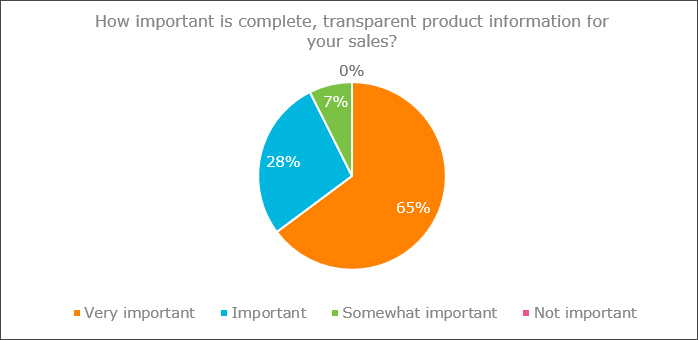

Complete and transparent product data is seen as either “important” or “very important” to sales by 93 per cent of respondents. Not a single respondent thought it to be a trivial part of their selling success - a firm indication of the overall need for complete and transparent product data.

Additionally, when asked if the importance of accurate product data has changed over the past five years, 80 per cent agreed that it is “more important now than it was five years ago”, with no-one selecting it as “less important”.

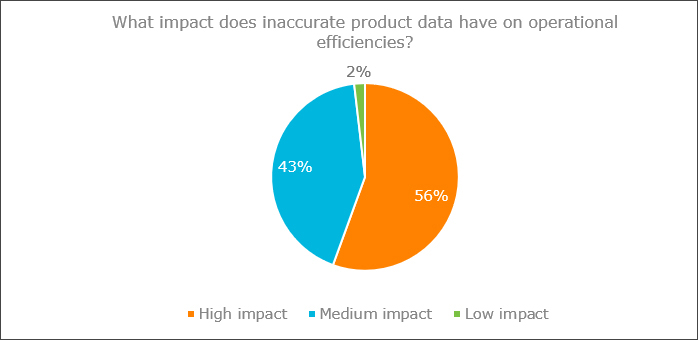

Moving from the impacts of good data to the consequences of bad data, we found that more than half of respondents felt that poor-quality data had a “high impact” on operational efficiencies, with only 2 per cent feeling it had a negligible part to play.

Interestingly, every company with an annual turnover of less than £10m said that poor data had either a high or medium impact on operational efficiencies, highlighting a need for the wider industry to ensure data quality.

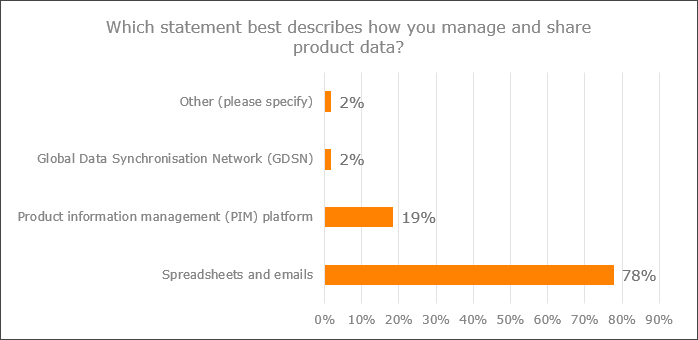

An overwhelming percentage of companies surveyed (78 per cent), said that they mostly use spreadsheets and emails to manage and share their product data with customers. This jumps by 16 per cent to 94 per cent for companies with an annual turnover less than £10m. A labour-intensive process which can be susceptible to and magnify human error, manual data entry will almost always have an effect on overall operational efficiency.

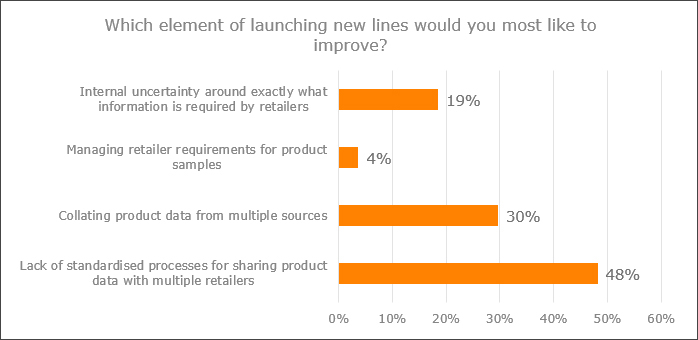

One of the key touchpoints for data sharing with retailers and wholesalers is the launch of new product lines. When asked which element of the new-lines process respondents would most want to improve, almost half of those surveyed said they would like to see a “standardised process for sharing data with multiple retailers”.

This was closely followed by approximately one in three citing “an easier way to collate product data from multiple sources”, with one in five respondents seeking more clarity around what information is required by retailers.

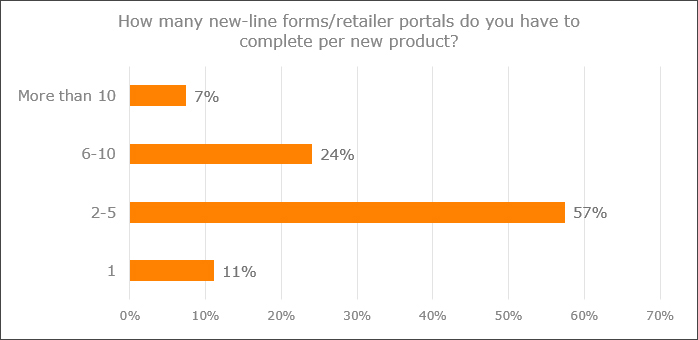

The results of the survey clearly point to the need for an easier, clearer way to collate and share product information that streamlines the new-lines process. This is underscored by the fact that 57 per cent of respondents said that they have to complete between two and five new-line forms/retailer portals per new product. This increases to 64 per cent for those with an annual turnover of less than £10m.

Significantly, one in three respondents have to complete more than six new-line forms/retailer portals per new product, with 7 per cent of those surveyed having to complete more than ten.

Again, this highlights just how labour intensive the manual process of launching new products to market can be for the average company.

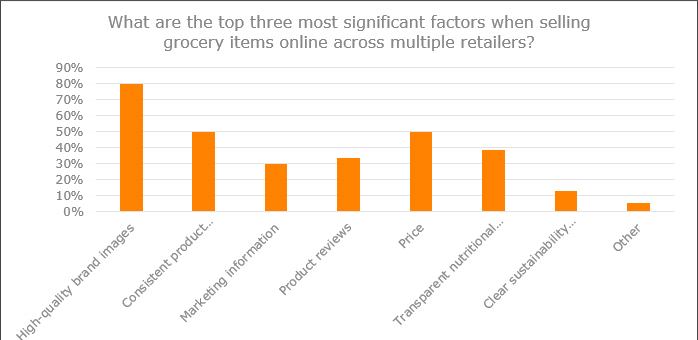

We also posed a question around what our respondents deemed to be the most important factors when selling grocery items through multiple online retailers.

High-quality brand images are seen as the most important factor by four in five of those surveyed, although this dropped to 54 per cent for those working for companies with a turnover of less than £10m. Half of respondents believed that both consistent product information and price were the next most important factors, with this changing to price (37 per cent), product information (28 per cent) and product reviews (28 per cent) for companies with a turnover of less than £10m.

This clearly shows that brand owners hold good product information, both visual and descriptive, as key influencing factors when selling grocery items online.

Conclusion

While not particularly sexy, the statistics show that high-quality product data is becoming more and more important to both retailers and brands, particularly as consumers become increasingly demanding about the products they buy.

But it is not just the data itself that is important – it is also the way in which it is captured and shared.

productDNA provides a one-stop shop for capturing and sharing product data with all retailers. Using a standardised, industry-designed data model, required product attributes are consistent across all retailers and are clearly explained within platform.

As a branded supplier, this means that you only need to capture your product data once to be shared directly with all your customers through the platform or via a full export.

The quality of all inputted data is also guaranteed, as every product entered into the platform undergoes an independent physical check for data accuracy and consistency. This means both suppliers and retailers have more confidence in the data provided, improving efficiency and trust across the entire industry.

Find out more about how productDNA works

Related

How Nestlé are using productDNA to improve the shopper experience