July 08, 2020 Industry news

2020 is the year that broke the mould for the retail industry. The COVID-19 outbreak put huge pressure on supply chains as consumers desperately tried to stockpile essential items. Supermarkets had to adapt quickly, and consumers changed the way they shopped.

The rise of online deliveries

Prior to the outbreak of coronavirus, Tesco had the capacity to make about 600,000 home deliveries a week. In the first five weeks of the lockdown, it had more than doubled that to more than 1.3 million.

Similarly, by the middle of April, Sainsbury’s had increased its capacity to more than 600,000 weekly home deliveries and click-and-collect slots.

Online groceries have taken 25 years to get to 8 per cent of our business, and eight weeks to get to 15 per cent, and it’s still growing like there’s no tomorrow.”

Mike Coupe, former CEO at Sainsbury's

While Coupe is unsure whether all of those customers will stick with online shopping, he is convinced e-commerce won’t go back to pre-coronavirus levels.

"I don’t know whether online volumes will stay at the 600,000 orders a week that we are currently experiencing, given that they started at about 350,000 a week, but I’m pretty certain they won’t go back to 350,000," he said.

Online retailers see sales surge

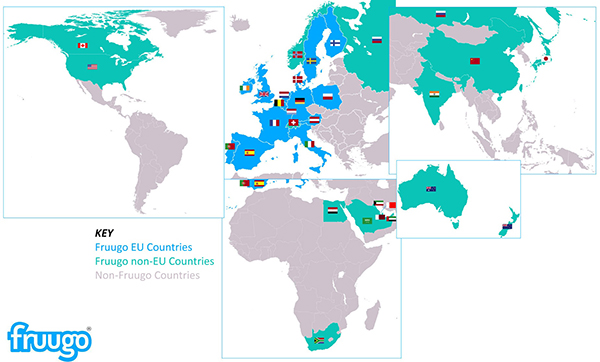

And it is not just grocers who are seeing significant increases in online traffic. When taking part in one of our “how-to” webinars at the end of May, chief revenue officer at global marketplace Fruugo, Håkan Thyr, discussed the dramatic increase in sales the company had seen as a result of Europe entering into lockdown.

We’ve basically had Christmas for two months now. This began when Europe started locking down, including the UK, so we have been above peak for the last year since the tail end of march”

Håkan Thyr, chief revenue officer at Fruugo

While this dramatic peak has tailed off in recent weeks, Fruugo don’t expect to return to the levels of trading they would have predicted prior to this pandemic. Thyr believes that there has been a “fundamental shift in consumer behaviour where people have gotten used to buying things online that they probably wouldn’t have before all this happened”.

The evolution of purchasing habits has also changed throughout the course of the pandemic. In the first few weeks, Fruugo saw panic buying of products. These were mostly essentials including toilet paper, face masks and hand sanitisers – bought by the five-litre jug, as opposed to small personal bottles.

A few weeks later, as many people realised they were going to be living and working from home for the long haul, sales of computer screens and wireless keyboards skyrocketed to accommodate the need for new home offices.

Consumers also started to think more about their health needs and what they could do to look after themselves in lieu of gyms closing, so sales of home exercise equipment and vitamins also saw a sharp rise.

As time progressed, people started to realise they needed to do things for themselves where they had previously sought out the help of professionals. This led to an increase in sales of hair colouring kits and clippers, sowing accessories and large quantities of flour, as home baking soared.

By the time Easter arrived and the weather improved, Fruugo saw an investment in garden and outdoor equipment, such as garden hoses and inflatable swimming pools. They also saw an increase in items for pets, such as flea and worm medicines, pet collars and pet food.

This “fundamental shift” in the way people purchase goods is likely to continue long after the COVID-19 pandemic. Consumers have become more comfortable and reliant on online shopping that ever before.

Even when the question around Brexit was raised on the webinar, and the potential uncertainties that could arise when expanding cross-border, Fruugo highlighted that there is more, not less, need to diversify your sales offering. This means not only thinking about multi-channel, but multi-platform and multi-territory.